Future Outlook

The future is electric (And Efficient)

What’s next for policy, technology, and market expectations?

Australia’s energy system

is in rapid transition.

New Technologies

New technologies such as heat pumps can be a viable alternative to gas, with higher upfront costs often offset by longterm savings.

Heat pumps can be 3–5 times more efficient than gas heating equipment.10

Investing in new efficient technologies when equipment needs replacing may reduce energy costs for building owners and tenants.

Commercial Buildings Disclosure

Commercial Building Disclosure rules may expand to new building types, requiring buildings to publish their NABERS rating.11

Offices over 1,000m² must already disclose their energy performance.12

The CBD program is expected to expand by 2030 to include hotels and large office tenancies. Other building sectors will be considered for inclusion in later stages.

NABERS Expansion

NABERS energy ratings for commercial buildings are expanding to include new types of buildings, information on renewable energy in buildings, and a new rating for embodied emissions.

The NABERS Renewable Energy Indicator measures the proportion of energy used in a building that is sourced from renewables.

New ratings may help make it easier for tenants to compare energy use and emissions in commercial buildings, offering transparency for tenants seeking to improve efficiency.

NCC Updates

Ongoing updates to the National Construction Code (NCC) are likely to lift energy efficiency standards and encourage fully electric or electrification-ready new buildings.

Proposed NCC 2025 changes would reduce energy consumption in new buildings by an estimated 20–50%.13

Higher standards for new buildings may widen the efficiency gap with existing buildings, making upgrades necessary to stay competitive and attract tenants focused on efficiency.

Climate Related Financial Disclosure

Some investors and larger businesses will be required to disclose the emissions from their investments under Climate Related Financial Disclosure rules.

Large entities will need to disclose emissions from their investments and operations and their targets for managing them, including in buildings.

Reporting businesses will likely have a greater incentive to focus on the emissions generated in their buildings. Smaller business that are part of the reporting supply chain may also be impacted.

Load Shifting

Increased daytime solar generation will likely incentivise energy use during daytime hours and energy savings during evening peak hours.

Over four million buildings have had solar installed in Australia.14

Cost savings will likely be available for buildings that shift energy use to times when energy generation exceeds demand.

Battery Storage

Battery storage is expected to mature and become widely available.

Small-scale battery storage in Australia is projected to grow from 1.5 GW in 2025 to 44.1 GW by 2050 – a 29-fold increase.15

Commercial buildings using building energy management systems may be well positioned to optimise energy use for renewables and batteries.

Electrification Policies

Natural gas use in new and existing buildings is expected to decline, as state and territory governments continue to explore policies that support electrification and emissions reduction.

ACT has already banned gas connections in new buildings16, and Victoria will require all new commercial buildings to be all-electric from 2027.17

Minimum Standards

Mandatory minimum energy performance standards may initially apply to existing large office buildings, with potential expansion to other sectors over time.18

Mandatory standards for energy efficiency already apply to new buildings.

Buildings may need to be upgraded if they do not meet minimum standards for energy efficiency.

Electric Vehicle Charging

Electric vehicles will increasingly require charging infrastructure in buildings.

To meet climate targets, 50% of new car sales need to be EVs by 2030.19

Installing EV charging infrastructure may become increasingly important to attract and retain tenants who own electric vehicles, enhancing the building’s appeal and future-proofing it against evolving transportation trends.

Embodied Emissions

With a renewables-led grid reducing operational emissions from energy in buildings, focus will increase on emissions produced by refrigerants and the construction materials of buildings, such as steel and concrete.

Embodied emissions of buildings made up around 16% of emissions in the built environment in 2022.20 This proportion is growing as energy decarbonises.

Minimising embodied emissions in retrofits is likely to become increasingly important as the focus shifts from operational to whole-of-life carbon.

Ongoing Electrification

Ongoing electrification of existing commercial buildings.

Natural gas used in commercial buildings generates around 2.4Mt CO₂ per year.21

Buildings with gas connections may become less attractive to tenants, who are prioritising fully electrified, fossil-fuel-free spaces to meet their net-zero commitments.22

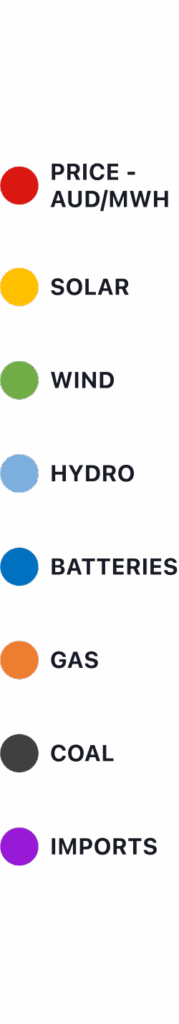

In 2000, fossil fuels accounted for over 96% of electricity generation in the National Electricity Market (NEM). By 2025, that share is projected to fall to 60%,23 as renewables like solar and wind become dominant — and increasingly cost-effective. Renewables are now the lowest-cost form of new build electricity technology. 24

The Australian government has a target of renewables supplying 82% of the grid by 2030.25

Commercial buildings play a central role in this broader energy transition — both as energy users and as opportunities for grid-aligned efficiency.

Improving energy efficiency in buildings reduces pressure on the energy system, helping to lower demand and support a smoother, more cost-effective transition to renewable energy.

Source: Open Electricity 2025, Averaged over 72 hr period between 10th to 13th May 2025

Source: Open Energy 2025, averaged over three-day period mid-May 2025 (72 hr period between 10th to 13th May)

Source: Open Energy 2025, averaged over three-day period mid-May 2025 (72 hr period between 10th to 13th May)

*Wholesale price data is not available for Western Australia.

Source: Open Energy 2025, averaged over three-day period mid-May 2025 (72 hr period between 10th to 13th May)

Source: Open Energy 2025, averaged over three-day period mid-May 2025 (72 hr period between 10th to 13th May)

QUEENSLAND

VICTORIA

NEW SOUTH WALES

WESTERN AUSTRALIA

SOUTH AUSTRALIA

TASMANIA

Source: Open Energy 2025, averaged over three-day period mid-May 2025 (72 hr period between 10th to 13th May)

Policy decisions and technological change are likely to shape the outlook for energy in commercial buildings over the decades ahead.

Policy decisions and technological change are likely to shape the outlook for energy in commercial buildings over the decades ahead.

Let us know

what you think.

Email our team:

futureready@westpac.com.au